So, it’s suddenly a little more clear why Chevron has become an election football:

As Chevron’s $52 billion Gorgon project became embroiled in the election campaign, trade union officials accused Chevron of seeking to dodge responsibility for poor labour productivity and high costs.

The union’s demands for employees working for 19 offshore oil and gas contractors around Australia include a 26 per cent raise over four years, no foreign labour without consultation, union control of hiring and four weeks holiday for every four weeks work.

Federal Energy Minister Gary Gray, who is under pressure in his Western Australia seat of Brand, said oil and gas companies were failing to control the costs of their staff and contractors.

“We do need our companies to get better in managing their productivity issues,” he said.

In Monday’s Australian Financial Review, Chevron Australia managing director Roy Krzywosinski said Australia has a two-year window to get policy settings right and fix industrial relations and productivity or risk losing out on billions of further investment in liquefied natural gas projects.

…The Coalition has already started taking steps to re-establish the Australian Building and Construction Commission, which could be used by the new federal government to help companies like Chevron overcome resistance from the union movement while they build expensive projects…Opposition resources spokesman Ian Macfarlane said the commission would be the “cop on the beat” of big projects.

…Paul Howes, national secretary of the Australian Workers’ Union, said: “I don’t see Chevron struggling to make a profit. I do not have a lot of sympathy in what is a supply-demand situation for the workforce. When there is a shortage of labour the labour is more expensive.”

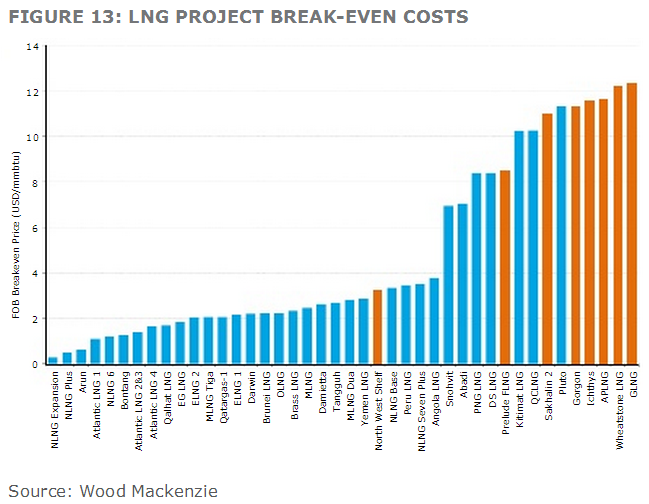

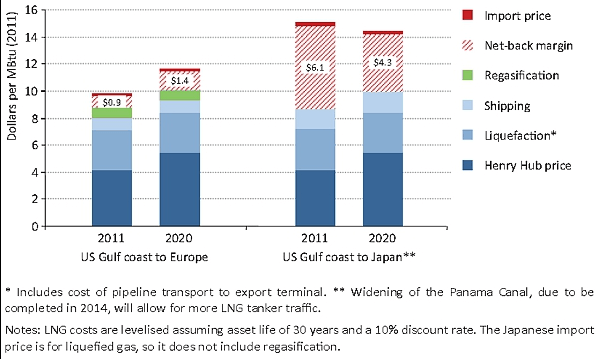

My view is that both sides have a point. The investment surge in LNG – often favourably compared with the Apollo moon program in its magnitude – is in some ways a bubble. Firms have rushed in, extrapolated an endless supply/demand imbalance for their product, ignored global competition, over-paid for assets and developed with little thought to what others were doing, grossly inflating input costs in the process. As a result Gorgon and every other project can’t land gas into north Asia for much less than $12 mmbtu. Compare that with yesteryear’s NW Shelf:

The US can match and beat these prices.

There other signs of an investment bubble too. According to Paul O’Malley, CEO of Blue Scope Steel:

“Very quickly after the election, we need the policymakers to get all the facts so they can look at the pros and cons of whether there’s reservation or no reservation, whether there should be improved ease of exploration and supply, whether there’s new pipelines needed,” he said.

…”If you look at energy costs (for BlueScope), the big factor is going to be gas and just the fact that natural gas prices are increasing,” the BlueScope boss said.

“We’re a bit challenged by that and we’re a bit challenged by the fact that LNG (producers) probably overestimated the amount of gas they’d be able to access and now they are taking it from residential and commercial-industrial users in Australia.”

This fallout is typical of the “built it and they will come” attitude that seized energy and mining executives in the final stages of the “commodity super cycle” boom. A similar story, with different dynamics, is playing out in coal and next year in iron ore.

The unions are largely not to blame for the cost blowouts even if they are a party to them. They are, after all, unions. What does capital think will happen if it hands them such a card to play?

I support the LNP’s move to reinstate the Australian Building and Construction Commission, and no doubt it can take some of the froth off the labour bubble that management has created. But there’s not much it will be able to do about genuine supply and demand imbalance. Only falling investment will do that.